(3) Fiberglass Market Growth Factors

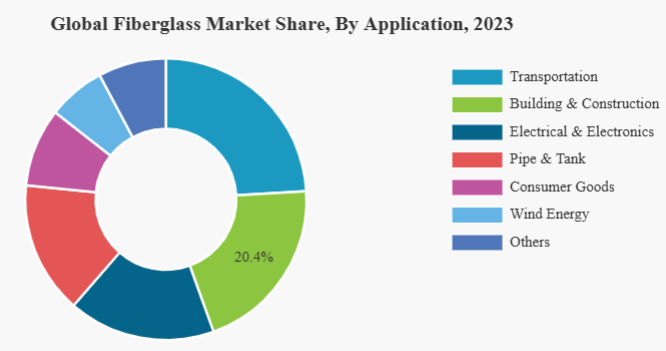

The growing demand for fiberglass in the transportation industry has become one of the key factors driving market growth. Since the introduction of large-scale pultrusion molding technology, fiberglass has played a crucial role as a reinforcement material in the transportation sector. By combining liquid resin matrices with continuous reinforced fibers, this material demonstrates exceptional structural integrity and has been widely adopted in ships, automobiles, and other transportation vehicles due to its high strength and excellent corrosion resistance.

Fiberglass, with its lightweight, high strength, and durability, is considered an ideal choice for manufacturing lightweight vehicles. These materials not only can be molded into various sizes and shapes but also offer aesthetically pleasing surface finishes, providing excellent protection in external environments. For example, the Chrysler brand uses fiberglass to manufacture support beams for blow-molded plastic fuel tanks, standing out in structural reinforcement and collision protection systems due to its superior thermal properties and corrosion resistance.

In the automotive industry, fiberglass is used as a substitute for steel and aluminum to produce lightweight vehicles, reducing CO2 emissions and improving fuel efficiency. The material is also widely used in the wind energy sector, supporting the sustainable development needs of the energy industry. With the implementation of stricter environmental regulations and the increasing demand for lightweight, high-performance materials, the application of fiberglass in the transportation sector will continue to expand, becoming a significant driver of market growth in the future.

(4) Limiting Factors

The growth of the fiberglass market is facing challenges related to environmental sustainability, with the emission of harmful substances being a major limiting factor. The production process of fiberglass is energy-intensive and resource-heavy. For every kilogram of molten glass produced, approximately 1 kilogram of carbon dioxide (CO2) is released, along with nitrogen oxides (NOx), sulfur dioxide (SO2), volatile organic compounds (VOCs), and particulate matter. Producing one ton of molten glass consumes 17 GJ of electricity, placing significant pressure on the environment.

Furthermore, fiberglass-reinforced polymers (GFRP) are widely used due to their excellent properties, but their thermoset polymer nature makes them difficult to melt or reshape, posing significant challenges for recycling. These materials also typically contain a large amount of inorganic fillers, which further complicates recycling efforts. As a result, about 25% of fiberglass products are sent to landfills at the end of their life cycle, with approximately 250,000 tons disposed of in landfills annually in Europe. This not only takes up limited landfill space but also causes harmful environmental impacts through incineration or accumulation.

Therefore, for the fiberglass industry to achieve sustainable development, it is essential to prioritize the development of innovative recycling technologies and solutions. Effective recycling of fiberglass and its composites can not only reduce environmental burdens but also enhance material recycling efficiency, laying the foundation for the long-term development of the market.

(5) Fiberglass Market Segmentation Analysis

1.Analysis by Glass Type

The electronic glass segment has gained momentum due to its widespread application across various end-use industries. In the fiberglass market, the segmentation by glass type divides the market into electronic glass and specialty glass, with the electronic glass segment holding the largest market share and expected to maintain this leading position during the forecast period.

Electronic glass is primarily made from alkali-free glass, also known as electrical glass. Alkali-free glass is composed of oxides of magnesium, silicon, calcium, aluminum, and boron. The products made from it offer excellent vibration resistance, wear resistance, and flexibility, which makes them widely used in marine, aerospace, and industrial sectors, while also being lightweight. As the industry standard, alkali-free glass fibers hold a significant position in the market due to their excellent cost-effectiveness and broad applicability. With increasing demand for environmental sustainability, the trend of using boron-free fibers is also growing, which is expected to drive further growth in this segment in the coming years.

Specialty glass includes S-glass, ECR-glass, D-glass, and AR-glass types, with E-glass being the most widely used in the fiber-reinforced polymer composite industry due to its strength, chemical resistance, heat resistance, and moisture resistance. Electronic glass is specifically designed for electrical applications, with outstanding insulating capabilities, making it a vital material in the electrical industry. As demand for electronic devices grows, the market share and application range of electronic glass continue to expand, and this segment is expected to show strong growth in the future.

2.Analysis by Product

With the continuous growth in the demand for insulation materials, the fiberglass mat segment is expected to dominate the fiberglass market. Based on product type, the market is primarily segmented into fiberglass mat, yarn, rovings, chopped strand, and others. In 2023, the fiberglass mat segment held the largest market share, mainly due to its widespread use as an efficient thermal and acoustic insulation material in the construction sector. Fiberglass mats are particularly suitable for interior spaces, such as sloped roofs, wooden floors, and internal walls, providing effective heat insulation and maintaining stable indoor temperatures. However, the insulation performance of fiberglass mats can be significantly affected by moisture, and once exposed to water, their thermal efficiency declines.

Additionally, glass filaments are cut into designated lengths to form chopped strands, which are coated with an oxide layer to improve the material’s processability and efficiency. Chopped strands are widely used in composite and injection molding technologies, especially in the production of fiber-reinforced plastics (FRP) and fiber-reinforced thermoplastic polymers (FRTP), typically combined with high-performance resins. The demand for these materials as reinforcing agents is increasing in industries such as automotive and electronics, where high strength and durability are required.

Therefore, fiberglass mats are expected to maintain a dominant position in the fiberglass market due to their excellent insulation properties and widespread demand, particularly in the construction sector. Meanwhile, the expanding application of chopped strands, especially in high-performance composite materials, will also drive further market development.